The State Financial institution of Pakistan (SBP)-held overseas alternate reserves maintained their uptrend for the second consecutive session, managing to remain above the $4 billion mark.

The reserves barely rose above $18 million, nonetheless, the quantity remains to be barely sufficient to cowl one month of imports.

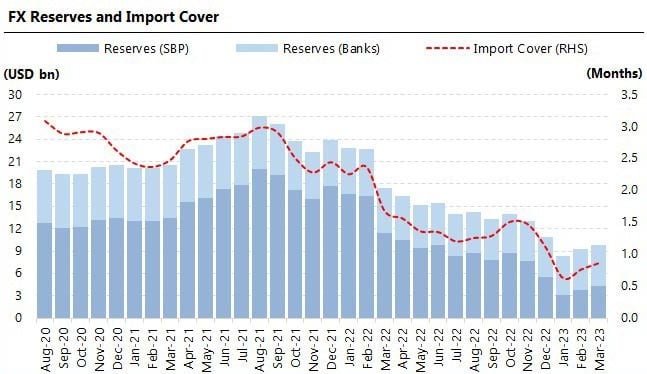

The central financial institution, in its weekly bulletin, stated that its overseas alternate reserves have elevated by $18 million to $4,319.1 million as of the week ended March 10, which can present an import cowl of round a month.

The web foreign exchange reserves held by business banks stand at $5,527.7 million, $1,208.6 billion greater than the SBP, bringing the whole liquid overseas reserves of the nation to $9,846.8 million, the assertion talked about.

The central financial institution didn’t point out any particular cause behind a rise in SBP-held reserves.

Pakistan faces the renewed danger of recession amid a deepening political and financial disaster and a delay within the revival of the Worldwide Financial Fund’s (IMF) bailout programme.

Bloomberg survey confirmed that the chance of the financial system slipping into recession stands at 70%, in accordance with the median forecast of 27 economists.

In the previous few months, the cash-strapped nation has failed to fulfill a number of deadlines to safe funds to stave off a default, which has raised considerations that Pakistan may need to pause debt repayments.

To be able to woo the IMF, Prime Minister Shehbaz Sharif-led authorities have raised taxes, lower vitality subsidies, and hiked rates of interest to a 25-year excessive to tamp down costs, however some points are but to be resolved.

Pakistan wants funds to revive its $350 billion financial system, ease widespread shortages and rebuild its overseas foreign money reserves. The nation’s greenback stockpile has fallen to lower than a month’s value of imports, limiting its capability to fund abroad purchases, stranding 1000’s of containers of provides at ports, forcing plant shutdowns and placing tens of 1000’s of jobs in danger.