Table of Contents

After a interval of low cryptocurrency volatility, the worth of Bitcoin (BTC-USD) fell sharply from $21,400 to $17,150 and is at the moment buying and selling in a slim worth vary of $18,100-$18,500 after a slight restoration. As described in my earlier Bitcoin article, the important thing cause for the autumn beneath the psychological threshold of $20,000 per Bitcoin is the Fed’s fourth consecutive improve within the Fed’s rate of interest to a document excessive up to now sixteen years. Traders proceed to massively withdraw from dangerous property, which solely will increase the stress in each the inventory and cryptocurrency markets, whereas extra conservative members with vital monetary assets search to attend out the interval of macroeconomic instability in property that convey dividends or coupon funds.

This text will current elements that point out continued downward strain on the worth of Bitcoin, however on the similar time, a few of them start to point the looks of the primary glimpses of hope for the top of the bearish pattern within the medium time period.

Bears management the scenario within the cryptocurrency market

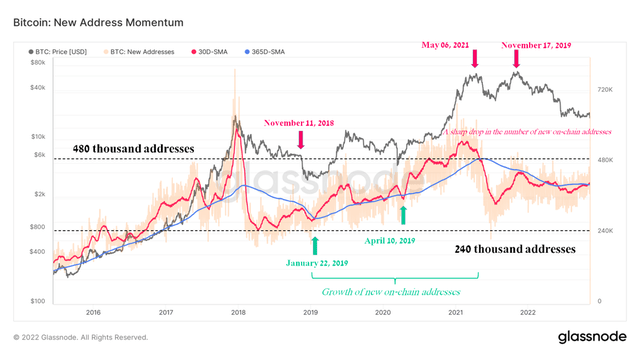

One of the vital efficient instruments for monitoring and modeling adjustments in tendencies within the cryptocurrency market and sentiment amongst Bitcoin customers is the evaluation of on-chain exercise. The dynamics of recent on-chain addresses proceed to say no from multi-year highs reached in Might 2021, when mass euphoria swept nearly all markets and new members opened wallets and invested in “digital gold”. Nevertheless, even then, the primary indicators of a lower in curiosity in Bitcoin appeared, as the common month-to-month fee of recent addresses fell beneath the 365-day easy transferring common marked in pink within the chart beneath. Furthermore, an identical scenario was noticed in February 2018, after which the worth of Bitcoin collapsed by 73% in lower than a yr. For the time being, the momentum of New Addresses is shut to a different upward spurt, because it occurred in November 2018 after a multi-month interval of low volatility and marked by a revival of hopes for the beginning of a brand new cycle of development in demand for Bitcoin. Nevertheless, this was a useless hope, as the worth of Bitcoin collapsed from $6,600 to $3,300, and thus lastly discouraged the vast majority of potential traders from shopping for “digital gold”. Furthermore, at occasions of most stress amongst market members and the following formation of a backside, the variety of new addresses all the time reached a price of 240 thousand, which we nonetheless haven’t seen. As a consequence, this as soon as once more signifies that the present worth vary will not be a backside earlier than a brand new up cycle begins.

Supply: Writer’s elaboration, based mostly on Glassnode

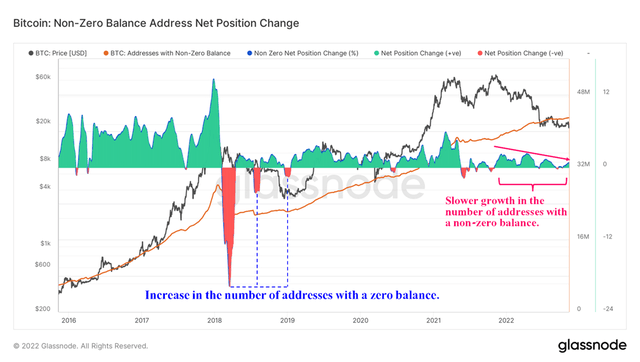

The logical consequence of the slowdown within the opening of recent crypto wallets is a slowdown within the development of the variety of addresses with a non-zero stability, as most traders proceed to alternate Bitcoin for fiat cash and reinvest it in monetary property with much less threat. The same scenario might be noticed within the first three quarters of 2018, when the worth of Bitcoin, after a pointy fall, remained in a slim worth vary of $3,200-$4,000 for a number of months, whereas the S&P 500 (SPY) and Nasdaq 100 (QQQ) continued their upward motion.

Supply: Writer’s elaboration, based mostly on Glassnode

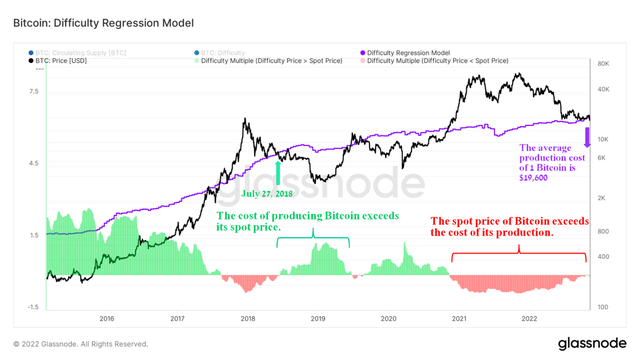

Miners proceed to expertise the toughest occasions

In my earlier article, “Anticipating Crypto Disaster: Bitcoin Value Would possibly Drop 35%”, I identified the continued dire scenario within the mining business, with hashrate and community problem setting new information and thereby upsetting corporations to dump extra cash to proceed their actions. As of November 9, 2022, Bitcoin’s common manufacturing value is $19,600 whereas the spot worth has fallen beneath $18,000. The final time an identical scenario occurred was 4 years in the past and ultimately led to a mass capitulation of miners. For the time being, miners earn solely 3.47 BTC per day for each Exahash, or 62.5 thousand in greenback phrases, which is 25.2% lower than final quarter. Elevated competitors amongst such mastodons of the business as Riot Blockchain (RIOT) and HIVE Blockchain Applied sciences (HIVE) doesn’t result in the restoration of the cryptocurrency market, however solely aggravates the scenario and the longer this occurs, the longer the interval of its restoration will proceed. I count on the sideways pattern within the $12,700-$13,600 worth vary, wherein extra affected person traders will accumulate cash of their wallets, to final slightly longer than earlier than. As a consequence, this can result in a major lower within the funding curiosity of those that attempt to make a fast revenue on this market and also will keep downward strain on the share costs of crypto miners.

Supply: Writer’s elaboration, based mostly on Glassnode

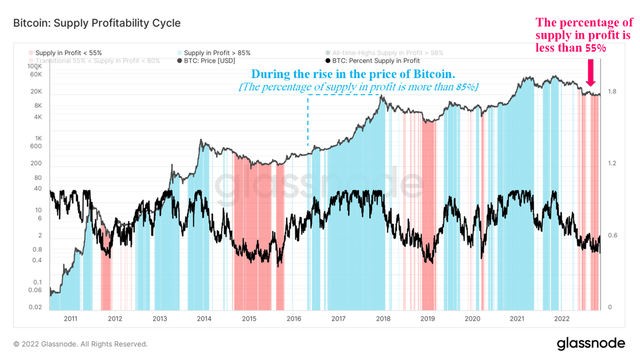

A interval of apathy amongst crypto market members because of a pointy drop within the profitability of their investments results in the transition of Bitcoin from extra impulsive traders to those that perceive the worth of cryptocurrencies. These tendencies will be analyzed utilizing the % of provide in revenue, which offers details about the state of the market cycle. For the time being, this indicator continues to be in a downward pattern and thus demonstrates the dominance of the share of provide in losses and, because of this, the preservation of bearish sentiment within the cryptocurrency market.

Supply: Writer’s elaboration, based mostly on Glassnode

Holders proceed to build up Bitcoin

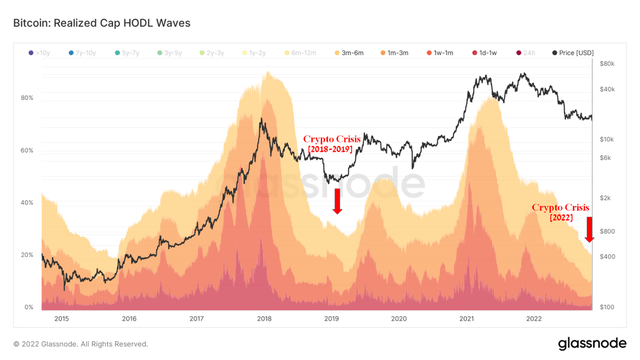

Regardless of the decline in curiosity and confidence in cryptocurrencies, long-term traders don’t lose optimism about the way forward for Bitcoin and proceed to build up it. The share of U.S. greenback wealth held in BTC that hasn’t moved within the final six months has hit a multi-year low. In earlier Bitcoin cycles, such extraordinarily low values had been marked by the formation of the underside of the principle cryptocurrency and, for my part, an identical scenario will repeat in 2022-2023.

Supply: Writer’s elaboration, based mostly on Glassnode

Conclusion

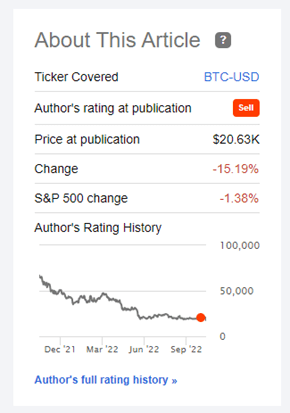

Since writing my final bearish article in October 2022, the worth of Bitcoin has fallen by greater than 10%, which is according to my expectations for the habits of the cryptocurrency market, which is experiencing capital outflows to much less dangerous property.

Supply: Nathan Aisenstadt — Looking for Alpha

The panic amongst high-risk property, together with these traded on the inventory market, doesn’t contribute to the transition of Bitcoin from a bearish pattern to a bullish one. The community problem units new multi-year information and thus reduces funding within the mining business, which is in dire want of further funding to purchase extra environment friendly tools. Furthermore, the rise in downward strain on the worth of Bitcoin comes at a time when one of many world crypto-currency exchanges, specifically FTX (FTT-USD), is dealing with a liquidity disaster and thus solely growing the chance of a domino impact on different market members.

Then again, conditions for the top of the bearish pattern are starting to seem because of a rise within the variety of long-term holders who’re assured within the shiny way forward for cryptocurrencies. As well as, I count on a slowdown within the Fed fee hike in 2023 as a result of slowdown in U.S. inflation and the victory of the Republicans within the elections to the Home of Representatives. Consequently, the Democrats won’t be able to advertise all their concepts, which required multibillion-dollar investments with the following rise in inflation, and because of this, this can result in an easing of the Fed’s financial coverage. Consequently, traders will start to think about investing in high-risk property akin to Bitcoin, Dogecoin (DOGE-USD), Ethereum (ETH-USD), and Cardano (ADA-USD). From the perspective of technical evaluation, as within the earlier article, I count on the worth of Bitcoin to say no to the vary of $12,700-$13,600, after which there will probably be a multi-month interval of accumulation and the cycle will begin once more.