Table of Contents

With Bitcoin (BTC -1.06%) delivering its greatest January efficiency since 2013, it is no shock that analysts are ratcheting up their value targets for this all of a sudden sizzling crypto. Bitcoin was up practically 40% in January, and that has led to a totally revised outlook for simply how excessive this crypto might fly in coming years.

Cathie Wooden of Ark Make investments — identified for her beforehand controversial $1 million value goal for Bitcoin — has simply ratcheted up her Bitcoin value prediction. She now thinks Bitcoin might skyrocket to $1.48 million by 2030. However simply how possible is that prediction?

The long-term progress story for Bitcoin

In line with Wooden, the case for Bitcoin at these stratospheric ranges is known as a story of huge progress on a worldwide scale. Over time, the story goes, Bitcoin will account for a bigger and bigger share of worldwide belongings held by establishments. It is going to proceed to scale globally as extra nations settle for it as authorized tender, and as extra folks use Bitcoin to hold out on-line transactions.

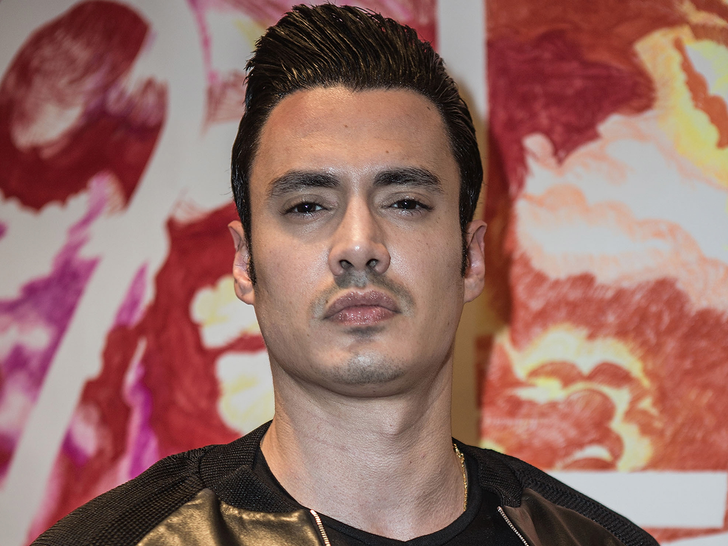

Picture supply: Getty Photographs.

This story will get extra fascinating when Ark Make investments lays out the precise numbers behind its assumptions. Ark Make investments suggests there might be eight major market segments (e.g., “rising market foreign money” and “remittance asset”) the place Bitcoin will see progress. Based mostly on estimates in regards to the penetration price for Bitcoin in every of these markets, it’s doable to develop a bearish, a base case, and a bullish situation for Bitcoin’s value.

How briskly can Bitcoin develop?

So, for instance, Ark Make investments means that Bitcoin might account for as much as 10% of the M2 cash provide of rising market nations. So far, there are solely two nations which have adopted Bitcoin as authorized tender — El Salvador and the Central African Republic — so this appears a bit optimistic. In line with some economists, nations that battle with hyperinflation or devalued currencies might resolve to embrace Bitcoin.

Ark Make investments additionally means that Bitcoin might seize 25% of the “remittance asset” market, and 50% of the “digital gold” market. So, think about one in 4 migrants world wide sending a refund to household and family members within the type of Bitcoin, and one in two central banks world wide deciding to construct their Bitcoin reserves as a substitute of their bodily gold reserves. As well as, Ark Make investments means that Bitcoin will quickly account for six.5% of institutional investor portfolio holdings.

All of those numbers are aggressive, however not fully unthinkable. It actually is dependent upon the way you view world progress, and the way a lot religion you have got in fiat foreign money.

From my perspective, the “base case” estimates supplied by Ark Make investments make much more sense than the “bullish case” numbers. For instance, in a base case situation, Bitcoin will solely account for 3% of the M2 cash provide of rising market nations. And Bitcoin will solely account for two.5% of institutional investor portfolios. The issue right here is that even Ark Make investments acknowledges that these “base case” assumptions solely help a future value of $682,800 for Bitcoin, nicely under the pie-in-the-sky determine of $1.48 million.

Do the numbers make sense?

Furthermore, it is useful to stress-test these assumptions about Bitcoin in opposition to present asset values in world markets. Provided that Bitcoin has a hard and fast coin provide of 21 million, a goal value of $1.48 million implies a complete market capitalization of $31 trillion.

Simply how huge of a quantity is that? Nicely, the entire worth of the world’s bodily gold provide is estimated to be value about $12 trillion, so Bitcoin could be value greater than 2.5x all of the gold on the planet immediately. Furthermore, the entire worth of the S&P 500 is roughly $32 trillion. So, Bitcoin could be value virtually the identical as the five hundred largest publicly traded firms in America immediately.

For that purpose, I do not assume $1.48 million is an inexpensive value goal for Bitcoin. Even a $1 million value goal appears to be a little bit of wishful pondering on the a part of the Bitcoin bulls. That will indicate a market cap of $21 trillion, which is almost 10x the present market cap of Apple. Would you slightly personal all of the Bitcoin on the planet, or all of the fairness in 10 completely different Apple firms?

Whereas I am long-term bullish on Bitcoin, I additionally assume it is essential to have a way of scale right here. If Warren Buffett thinks the worth of all of the Bitcoin on the planet is not even $25, and Cathie Wooden thinks the worth of all of the Bitcoin on the planet is $31 trillion, a rational individual would say that the true worth of Bitcoin is someplace within the center. I am bullish that Bitcoin will finally regain its $1 trillion market cap — I simply assume it can take longer than some folks assume.